RKLY Stock – Rockley Photonics Holdings Limited, a global medical technology company focused on providing front-line silicon photonics-based bio pick up results by directing a portfolio of biomarkers, announced today that it £12.9 million (US$15.5 million) for its FY20 R&D tax credit from HMRC, the UK Government’s tax authority. The Company has filed its FY2021 R&D tax thanks application and expects to file its FY2022 R&D tax credit application in 2023.

Table of Contents

About Rockley Photonics

Founded in 2013, Rockley is a global medical technology company that provides state-of-the-art silicon photonics-based bio identifying solutions training a collection of biomarkers. Rockley’s breakthrough end-to-end biosensor platform exposes unique spectrum-based biomarkers that offer visions into personal health and well-being. Rockley is arranging the groundwork for a new generation of biomedical applications in multiple industries with next-generation biosensor platforms designed clearly for mobile health specialist care.

why is rockley photonics stock falling

Rockley Photonics (RKLY) shareholders lagged the market by a wide margin on Wednesday, as the stock was down 22% by 11:15 a.m. ET. The health monitoring technology specialist reduced its near-term outlook after calling off a proposed sale of part of its business. The broader market was up 0.7% at the time.

Rockley announced late Tuesday that the proposed sale to China-based company Jiangsu Hengtong Opti-Electric would not go. The deal would have divested its communications technology and allowed Rockley to focus on its photonic health monitoring devices and solutions. The proposed agreement encountered a regulatory challenge.

Even though Rockley should still be able to make money with its datacom technology, investors may have to wait for a few more residences before seeing returns from this respected piece of intellectual property.

Is RKLY a good buy?

On average, Wall Street analysts predict that Rockley Photonics Holdings’s share price could reach $7.75 by Nov 10, 2023. The average Rockley Photonics Holdings stock price prediction forecasts a potential upside of 4,066.67% from the current RKLY share price of $0.19.

What does Rockley Photonics do?

Rockley Photonics is a silicon photonics stable focused on medical technology going public through a SPAC ($SCPE). They have developed a different, non-invasive multimodal method for biomarker monitoring. Rockley’s process involves many lasers on a single microchip springing back off a human to measure lactate, alcohol, CGM (glucose), hydration, body temperature, blood pressure, blood oxygen, and heart rate. This technology that Rockley has developed is so compelling Apple has already paid them $70M in engineering fees. And also, SemiAnalysis trusts that Apple watches 2022 or 2023 will begin integrating this photonic sensing platform.

Why Photonics Is The Future?

The ECOC exhibition allows the showing of the latest products, services, and designs in the fibre optic communication technology industry. The exhibition focuses on different markets, including photonics, the physical science of generating, controlling, and detecting light waves.

The Advanced Industry for Technology (ATI) project has recently published the Product Watch on Photonics technology for high-intensity farming. It reports zooms in on photonics technologies’ use in the agricultural sector. The report provides an overview of the context, value chain and relevant stakeholders and outlines the key players and their strengths and weaknesses. Explore the ATI project website for more information on advanced technologies or innovation centres in Europe.

Rkly stock discussion

Its value score of F suggests it would be a poor pick for value investors. RKLY’s financial health and growth prospects demonstrate its potential to underperform. And also, Zacks proprietary data shows that Rockley Photonics Holdings Limited is currently ranked Zacks Rank 3, and we expect an in-line return in RKLY shares relative to the market over the next few months. In addition, Rockley Photonics Holdings Limited has a VGM score of D (this is a weighted average of each style score, allowing you to focus on the stocks

Rockley Photonics News

Founded in 2013, Rockley is a global medical technology company that provides state-of-the-art silicon photonics-based biosensing solutions targeting a portfolio of biomarkers. Rockley’s advance end-to-end biosensor platform unlocks unique spectrum-based biomarkers that offer insights into personal health and well-being. Rockley is laying the preliminaries for a new age group of biomedical applications in multiple industries with next-generation biosensor platforms designed explicitly for mobile health monitoring.

Rkly Stock Price Today

Based on 1 Wall Street analyst offering 12-month price targets for Rockley Photonics Holdings in the last three months. Therefore, average price target is $1.00, with a high forecast of $1.00 and a low forecast of $1.00. The average price target represents a 419.75% change from the last price of $0.19. And also, RKLY is -$0.19 with a range of -$0.24 to -$0.17. Therefore, previous quarter’s EPS was $0.14. RKLY beat its EPS estimate 50.00% of the time in the past 12 months, while its overall industry beat the EPS estimate 62.82% in the same period. In the last calendar year, RKLY has Underperformed its general industry.

Rkly Stocktwits

Rockley Photonics Holdings’s analyst rating consensus is a Moderate Buy. It is based on the ratings of 2 Wall Streets Analysts.

Rkly Reddit

Ape wisdom is a stock sentiment tracker that tracks the most popular stock and crypto boards on Reddit and 4Chan.

Ape Wisdom not only a WSB tracker. And it tracks many different discussion boards including:

- WallStreetBets (WSB)

- r/stocks

- r/investing

- 4chan /biz

- and many more

Rockley Photonics Valuation

Rockley Photonics has raised a total of $448.5M in funding over 9 rounds. Their latest funding was raised on Oct 3, 2022 from a Post-IPO Debt round.Rockley Photonics is registered under the ticker NYSE:RKLY. Rockley Photonics is funded by 10 investors. Medtronic and Senvest Management are the most recent investors. In a note out this morning, investment banker Cowen initiated coverage of Rockley stock with an outperform rating and a $22 price target that implies the stock will more than double over the next year.

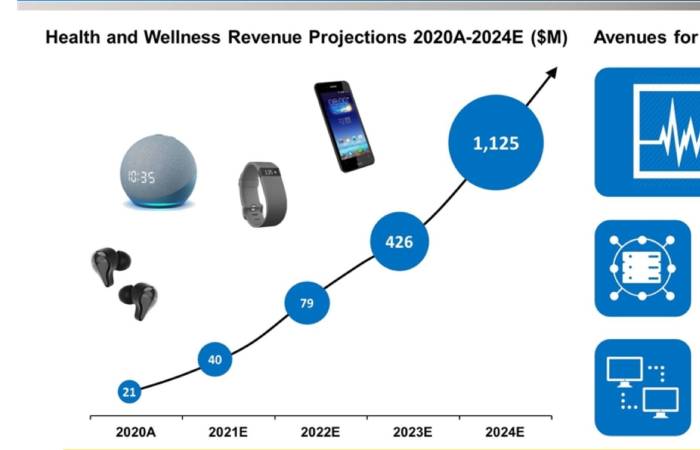

RKLY’s silicon photonics sensing platform addresses a well over $48B” total addressable market, explained Cowen in its note, covered today on StreetInsider.com. “We expect strong initial adoption by leading consumer wearable device companies focused. On expanding and enhancing health and wellness applications followed by eventual penetration of the medical device market.