Fidc Ipanema – In the financial market, it is common for people and companies to face difficulties in paying their dividends. In these cases, it is possible to rely on the assistance of companies specialized in assisting in credit recovery, such as in the case of the FIDC Ipanema.

But, in the end, what is this FIDC, and how does your work work? This text will explore this and other information about Ipanema, confirming that it is a trustworthy company and how it can help negotiate payments.

Table of Contents

What About FIDC Ipanema?

FIDC Multisegmentos NPL Ipanema IV Nao Padronizado is an open-end Fund incorporated in Brazil. The objective of the Fund is to have long-term capital appreciation. The Fund will invest its assets in credit receivables.

FIDC Ipanema acts as a securitizer and credit recoverer. This means that its primary function is to acquire assets from banks, stores, and other establishments, assuming the role of creator.

From this point on, the company begins the credit recovery process, involving the identification of unaccompanied debtors, the realization of collections, and the negotiation of payment of the assets.

Why do you have a Division with FIDC Ipanema?

If you have a division with the FIDC Ipanema, the company acquired your original division.

In many cases, when a person cannot pay their debts directly to the original creditor, such as a bank, the debt can be sold to a credit recovery company such as Ipanema.

In this way, FIDC assumes responsibility for the collection and negotiation of these divisions.

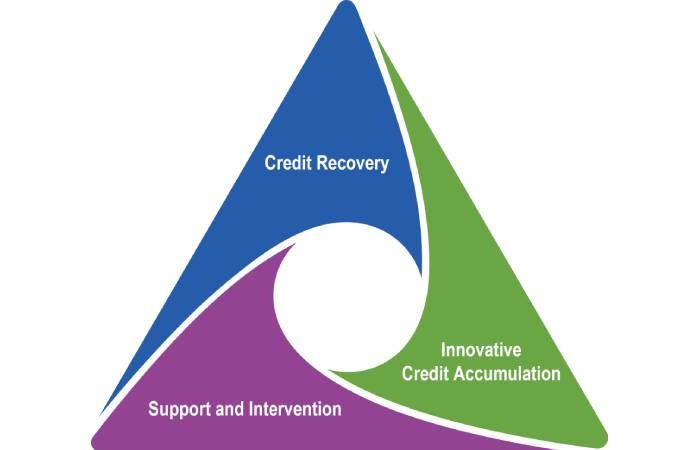

What is a Credit Recovery System?

Credit recovery companies, such as in the case of Ipanema, play an essential role in the financial market.

They contribute to guarantee that creditors receive the value owed and that debtors can regularize their dividends.

In addition, recovery companies help make new credit opportunities viable for borrowers. Ultimately, we can return to a positive credit history by removing your assets.

Is FIDC Ipanema trustworthy?

When we consider the reliability of the FIDC Ipanema, it is interesting to evaluate some indicators.

Do Not Claim Here, for example, a company has a reputation considered “Bom,” with a score of 7.1 out of 10.

Além disso, 99.4% of the complaints registered are answered, demonstrating a concern in serving clients. Another relevant fact is that 50.1% of the clients would be willing to do business again with the company.

Finally, the rate of solution of the complaints is 76.4%, which indicates an excellent capacity to resolve the problems presented.

Company is not Serasa Limpa Nome

The FIDC Ipanema partnership with Serasa Limpa Nome offers additional facilities for those who wish to negotiate their assets.

Through this partnership, obtaining special conditions to remove your debts is possible. It is essential to highlight that this relationship with Serasa also indicates that FIDC Ipanema is a trustworthy company that helps debtors regularize their financial debts.

How do we Negotiate a Division with the FIDC Ipanema in Limpa Nome?

The process is simple if you have a division with the FIDC Ipanema and want to negotiate through the Serasa Limpa Name.

- Access the Serasa Limpa Nome platform.

- Then, inform your CPF and sign in to log in.

- Check the part related to Ipanema and click on “See offer.”

- Next, select a payment option and define an expiration date for the ticket.

- Finally, confirming the chosen conditions and pay as agreed is enough.

As we saw in this text, FIDC Ipanema operates the credit recovery market, assisting creditors and debtors.

Therefore, if you know the name of this company in a business without understanding what is happening, don’t worry because it works with purchasing a business.

FIDC Da Ipanema – more

This Fund is a desirable option for beginning investors, and it is from Renda Fixa. Likewise, the amount invested remains based on a previously combined rate.

The FIDC is a conservative investment, free of significant risks, and requires a minimum value for application. In this way, we apply the knowledge of the exact value in your account at the end of the process.

You can choose two types of FIDC:

- Open farm: At any time, you can request or withdraw your quotas, obeying the rules of the farm that apply.

- Dated property: Here, the resgate of the dimensions can only remain done after a period generally established at the time of contract assignment.

The advantages of investing in this Fund are the best option to vary your investment portfolio, good profit, chances of investing in the secondary market, and transparency – because as the risk agency catalogs it, the prices must be on par with these risks.

The disadvantages are as follows: only investments are qualified, not insured by FGC (Fundo Guarantee of Credits), the minimum value for assets of R$25 thousand, and low liquidity due to its restriction.

Conclusion

We are FIDC Ipanema representatives, and we can help you. Regularize your pending issues with practicality through our channels with our help.

It is opportune to highlight that the FIDC Ipanema VI Report contains this reply letter from Serasa that informs that there are no negative names in the Author’s standing at your request… VI – NOT REGISTERED, following the constitutive documents that follow, duly registered in the CNPJ/MF under the common number endereço for correspondence to CEP, by your lawyer that this subscribe, with instrument… flagrant abuse of right of money Origin of negative debit Legitimidade da dívida Inexistence of moral damage Litigância de ma-fé PROCESSO nº FUNDO DE INVESTIMENTO EM DIREITOS CREDITÓRIOS MULTISEGMENTOS IPANEMA